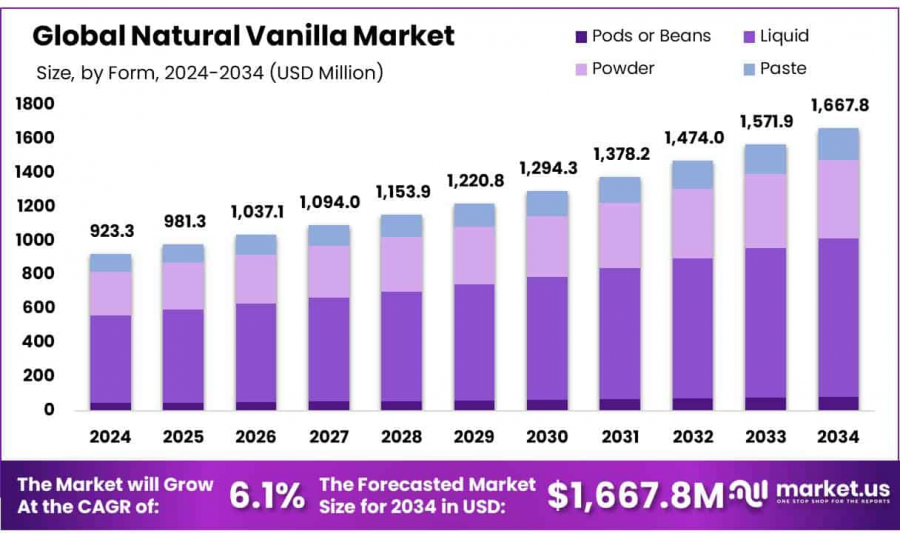

Natural Vanilla Market Value To Hit USD 1,667.8 Million by 2034

Natural Vanilla Market size is expected to be worth around USD 1667.8 Mn Bn by 2034, from USD 923.3 Mn in 2024, growing at a CAGR of 6.1%

NEW YORK, NY, UNITED STATES, February 28, 2025 /EINPresswire.com/ -- The global Natural Vanilla Market, as detailed in the Market.us report, is poised for significant growth, projected to reach USD 1,667.8 million by 2034 from USD 923.3 million in 2024, with a CAGR of 6.1%. This surge is driven by increasing consumer preference for organic and clean-label products, fueled by heightened awareness of health benefits and sustainability.

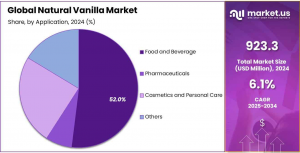

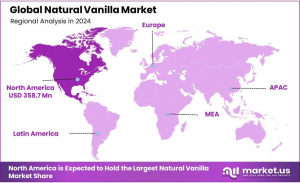

Natural vanilla, derived from vanilla beans, dominates various industries, including food and beverages (52% market share), cosmetics, and wellness, due to its authentic flavor and perceived health advantages over synthetic alternatives. North America leads with a 38.8% market share, while Asia-Pacific is expected to see the highest growth rate at 6.8% CAGR, reflecting expanding food and beverage sectors.

Liquid natural vanilla holds a 56% share among forms, and organic variants command 80.8% of the market by nature, underscoring the shift toward natural ingredients. Direct sales/B2B channels account for 72.2% of distribution, highlighting robust business-to-business demand. The market’s evolution is shaped by technological advancements in flavor extraction, government incentives promoting natural alternatives, and a regulatory push for transparency and ethical sourcing. However, challenges such as high production costs and supply chain vulnerabilities persist, tempered by opportunities in premium and plant-based product segments.

Key Takeaways

1. Market Growth: Projected to reach USD 1,667.8 million by 2034 at a 6.1% CAGR.

2. Dominant Segments: Food and beverage (52%), liquid form (56%), organic nature (80.8%).

3. Regional Insights: North America (38.8% share), Asia-Pacific (6.8% CAGR).

4. Distribution: Direct sales/B2B leads with 72.2% share.

Trends: Rising demand for organic, clean-label products and sustainable sourcing.

➤ 𝐒𝐚𝐦𝐩𝐥𝐞 𝐑𝐞𝐩𝐨𝐫𝐭 𝐑𝐞𝐪𝐮𝐞𝐬𝐭: 𝐔𝐧𝐥𝐨𝐜𝐤 𝐕𝐚𝐥𝐮𝐚𝐛𝐥𝐞 𝐈𝐧𝐬𝐢𝐠𝐡𝐭𝐬 𝐟𝐨𝐫 𝐘𝐨𝐮𝐫 𝐁𝐮𝐬𝐢𝐧𝐞𝐬𝐬: https://market.us/report/natural-vanilla-market/request-sample/

Experts Review

Government Incentives and Technological Innovations: Governments globally are tightening regulations on synthetic flavorings, offering incentives to shift toward natural vanilla, boosting its adoption. Advances in flavor extraction and processing enhance product shelf-life and quality, reducing waste and expanding applications.

Investment Opportunities & Risks: Opportunities lie in sustainable vanilla production and premium product lines, particularly in North America and Asia-Pacific. However, risks include volatile raw material costs and supply chain disruptions due to climate dependency.

Consumer Awareness: Growing health consciousness drives demand for natural vanilla, with consumers prioritizing transparency and ethical sourcing, pushing brands to adapt.

Technological Impact: Innovations like improved extraction methods enhance flavor profiles, supporting market growth, though scaling these technologies requires significant investment.

Regulatory Environment: Stringent labeling and sustainability regulations favor natural vanilla, creating compliance challenges but also opportunities for differentiation. Experts suggest that companies investing in traceable, high-quality vanilla supply chains will gain a competitive edge, though they must navigate rising costs and regulatory complexity.

Report Segmentation

The Market.us report on the natural vanilla market offers a comprehensive segmentation to provide detailed insights into its dynamics. By form, it categorizes the market into liquid (56% share), powder, and paste, reflecting varied consumer and industrial preferences. Based on nature, it distinguishes between organic (80.8% share) and conventional, highlighting the dominance of organic due to health trends.

The application segment includes food and beverage (52% share), cosmetics, pharmaceuticals, and others, underscoring vanilla’s versatility across industries. In terms of distribution channels, it segments into direct sales/B2B (72.2% share), retail, and e-commerce, emphasizing the prevalence of business-to-business transactions. Regionally, the report covers North America (38.8% share), Asia-Pacific (15.2% in 2024, 6.8% CAGR), Europe, Latin America, and the Middle East & Africa, providing a global perspective on market growth and regional variations. This segmentation enables stakeholders to identify high-growth areas, tailor strategies, and address specific market needs effectively.

➤ 𝐁𝐮𝐲 𝐍𝐨𝐰 𝐭𝐡𝐢𝐬 𝐏𝐫𝐞𝐦𝐢𝐮𝐦 𝐑𝐞𝐩𝐨𝐫𝐭 𝐭𝐨 𝐆𝐫𝐨𝐰 𝐲𝐨𝐮𝐫 𝐁𝐮𝐬𝐢𝐧𝐞𝐬𝐬: https://market.us/purchase-report/?report_id=140362

By Form

• Pods or Beans

• Liquid

• Powder

• Paste

By Nature

• Organic

• Conventional

By Application

• Food and Beverage

• Bakery

• Cakes & Pastries

• Cookies & Biscuits

• Muffins & Cupcakes

• Others

• Dairy & Dairy Products

• Ice-cream

• Yogurt

• Flavored Milk

• Desserts

• Milkshakes

• Cream

• Others

• Beverages

• Alcoholic Beverages

• Non-alcoholic Beverages

• Confectionary

• Chocolate Confectionery

• Sugar Confectionery

• Others

• Pharmaceuticals

• Dietary Supplements

• Medicinal Drugs

• Cosmetics and Personal Care

• Perfumes

• Skin Care

• Hair Care

• Lip Care

• Others

• Others

Drivers, Restraints, Challenges, and Opportunities

1. Drivers: The primary driver is the rising consumer demand for natural and organic products, spurred by health awareness and a preference for clean-label goods. Growth in the food and beverage industry, especially in bakery and premium segments, further propels demand.

2. Restraints: High production costs due to labor-intensive cultivation and reliance on specific climates limit scalability and affordability compared to synthetic alternatives.

3. Challenges: Supply chain vulnerabilities, exacerbated by climate change (e.g., cyclones in Madagascar), pose risks to consistent supply. Additionally, maintaining quality amidst increasing demand strains resources.

4. Opportunities: Expansion into plant-based and premium product markets offers growth potential. Sustainable and ethical sourcing practices can attract environmentally conscious consumers, while technological innovations in processing provide avenues for efficiency and product diversification, enhancing market competitiveness.

Key Player Analysis

Key players in the natural vanilla market include Givaudan, Firmenich SA, Symrise, McCormick & Company, and Nielsen-Massey Vanillas, driving innovation and market expansion. Givaudan and Firmenich focus on sustainable sourcing and advanced extraction technologies, strengthening their global presence. Symrise leverages its flavor expertise to cater to premium segments, while McCormick emphasizes diverse vanilla offerings, from gourmet to value-priced extracts. Nielsen-Massey prioritizes quality and traceability, appealing to health-conscious consumers. These companies invest in partnerships with farmers, R&D, and certifications (e.g., Organic, Fair Trade) to enhance supply chains and meet rising demand, maintaining a competitive edge through quality and sustainability.

• The Archer-Daniels-Midland Company

• International Fragrance and Flavors Inc.

• Kerry Group Plc

• Givaudan SA

• McCormick & Company Inc.

• Firmenich SA

• Symrise AG

• B&G Foods Inc.

• Sensient Technologies Corporation

• Takasago International Corporation

• Synthite Industries Private Ltd

• PROVA SAS

• Adams Flavours

• Nielsen-Massey Vanillas

• Sensate Pty. Ltd

• Tharakan and Company

• Other Key Players

Recent Developments

In June 2024, French supplier Euringus launched three clean-label vanilla extracts, aligning with demand for transparency and natural ingredients. In September 2022, Israel-based Vanilla Vida introduced advanced imaging and natural cultivation techniques to improve vanilla quality. In January 2021, Blue Pacific Flavors debuted “Kilimanjaro Vanilla,” a sustainable extract, catering to clean-label trends. These developments reflect a broader industry shift toward innovation, sustainability, and consumer-driven product offerings, enhancing market appeal and addressing ethical sourcing demands.

Conclusion

The Natural Vanilla Market is on a robust growth trajectory, driven by consumer demand for organic, sustainable products and supported by technological and regulatory tailwinds. With a projected value of USD 1,667.8 million by 2034, opportunities abound in premium and plant-based segments, though high costs and supply challenges persist. Companies prioritizing innovation, quality, and ethical practices are well-positioned to thrive, particularly in North America and Asia-Pacific. As awareness and regulations evolve, the market promises long-term potential for stakeholders adept at navigating its complexities.

Lawrence John

Prudour

+91 91308 55334

Lawrence@prudour.com

Distribution channels: Food & Beverage Industry

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release