Geographic Atrophy Market at a Turning Point: From Slowing Progression to Restoring Vision | Competitive Intelligence

GA treatments are advancing rapidly, with oral, gene, and cell therapies emerging as contenders to intravitreal injections in preserving vision.

AUSTIN, TX, UNITED STATES, June 9, 2025 /EINPresswire.com/ -- Geographic Atrophy (GA), a late-stage and irreversible form of dry age-related macular degeneration (AMD), has long symbolized a dead end in the journey to preserve sight. Characterized by the progressive degeneration of the retinal pigment epithelium, photoreceptors, and surrounding support tissue, GA leads to central vision loss-a critical blow to quality of life for millions of older adults. As the global population ages, GA’s burden grows heavier, with an estimated 5 million people affected worldwide, including over 1 million in the U.S. alone. Yet, for years, treatment options remained virtually nonexistent.

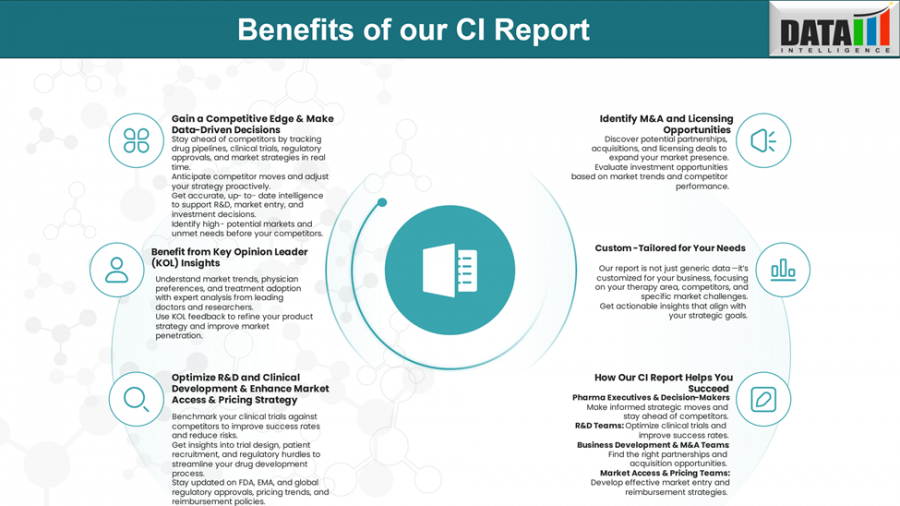

Book Your Free CI Consultation Call: https://www.datamintelligence.com/strategic-insights/ci/geographic-atrophy-ga

That paradigm is now shifting.

A Landscape Defined by Milestone Approvals

Until recently, patients and physicians had no pharmacologic recourse. But in the past two years, the U.S. Food and Drug Administration has greenlit two targeted therapies that mark a significant breakthrough: Syfovre (pegcetacoplan) by Apellis Pharmaceuticals and Izervay (avacincaptad pegol) by Astellas Pharma. Both are intravitreal injections that target the complement system, a key contributor to retinal inflammation and cell death in GA.

Syfovre inhibits complement component C3, offering broad suppression across the complement cascade. Izervay, in contrast, selectively inhibits C5, aiming for efficacy with a potentially more favorable safety profile. Their approval represents a long-awaited step forward, transforming a previously untreatable condition into a manageable disease-at least in theory.

However, enthusiasm is tempered by real-world complexity. Monthly or bimonthly eye injections carry risks-most notably intraocular inflammation, a safety signal associated with Syfovre-and impose a significant treatment burden on elderly patients. Additionally, while these drugs can slow the progression of GA lesions, they do not restore lost vision or significantly improve functional outcomes like reading speed or contrast sensitivity.

The Pipeline Awakens: A New Generation of Therapies

As of mid-2025, the treatment landscape is in the midst of a competitive and technological renaissance. More than half a dozen late-stage candidates are racing toward the market, aiming to challenge or complement the status quo.

Regeneron’s pozelimab, a C5 inhibitor in Phase III trials, is perhaps the most direct competitor. Leveraging Regeneron’s strong retina portfolio, it poses a high threat to existing market leaders. Meanwhile, Annexon’s ANX007, a C1q inhibitor, represents a mechanistically novel approach targeting upstream complement activity with added neuroprotective benefits.

But the most disruptive contenders come from outside the intravitreal injection space. Belite Bio’s Tinlarebant, an oral RBP4 inhibitor, offers a daily pill that sidesteps the logistical and emotional challenges of eye injections. Similarly, Gildeuretinol by Alkeus is exploring the vitamin A pathway with oral systemic delivery aimed at reducing retinal stress.

Adding further depth to the field are therapies exploring regenerative and long-term solutions. Roche’s OpRegen, a subretinal cell replacement therapy, seeks to regenerate lost retinal pigment epithelium cells. Johnson & Johnson’s gene therapy candidate JNJ-1887 aims for durable complement inhibition via a single intravitreal injection-a potential game-changer if successful.

Market Momentum and the Rise of the Target Opportunity Profile (TOP)

With multiple late-phase contenders poised for readouts between 2025 and 2027, developers are increasingly judged by their Target Opportunity Profile (TOP)-a multi-dimensional framework assessing not just efficacy and safety, but also delivery method, durability, innovation, and functional benefit.

A high-value therapy in this evolving landscape must go beyond anatomical slowing. It must preserve or improve visual function, minimize side effects, and ideally reduce the frequency of administration. Oral drugs like Tinlarebant and Gildeuretinol score high on patient convenience, while gene and cell therapies offer the tantalizing prospect of single-dose, long-lasting solutions.

From a payer and provider perspective, differentiation is key. Novel mechanisms of action such as ANX007’s C1q inhibition or AVD-104’s siglec-targeted nanoparticle technology introduce innovation that could address patient subtypes who are non-responsive to existing drugs.

Moreover, dosing frequency and route of administration are taking center stage. The real-world success of any emerging GA therapy hinges on its ability to reduce clinic visits and improve compliance among a predominantly elderly population. Sustained-delivery implants, gene therapies, or oral regimens have clear advantages in this context.

Competitive Positioning: A Strategic Chessboard

While Syfovre and Izervay currently dominate the market, they face increasing competition from therapies designed for ease-of-use and differentiated clinical value. Regeneron’s pozelimab is a direct competitor with strong corporate backing. Belite’s Tinlarebant and Alkeus’s Gildeuretinol address a different market segment entirely-patients wary of intravitreal injections. Annexon’s ANX007 could appeal to early-stage GA patients thanks to its neuroprotective mechanism.

Cell-based and gene therapies, though still in earlier stages, present long-term threats with the potential to redefine treatment expectations. However, scalability, delivery challenges, and cost-effectiveness will be critical hurdles to overcome.

A Market Poised for Reimagination

The GA market, currently valued in the low billions, is set for robust growth through the end of the decade. But more than financial metrics, it is the transformation in patient experience and clinical possibility that will define this new era.

To achieve commercial success and physician buy-in, future GA therapies must offer a balance of safety, efficacy, innovation, and convenience. Emerging treatments will only be as strong as the real-world outcomes they can deliver-preserved independence, improved daily function, and hope for those slowly going blind.

Download Free CI Sample Report: https://www.datamintelligence.com/strategic-insights/ci/geographic-atrophy-ga

Final Word

Geographic atrophy is no longer a therapeutic void. With a rapidly advancing pipeline, the market is shifting from a mindset of damage control to one of proactive preservation-and even potential restoration-of vision. As new entrants race toward approval, they must answer a singular question: Can they improve not just the lesion, but the life behind the lens?

Read Related CI Reports:

1. Lupus Nephritis | Competitive Intelligence

2. Immune Thrombocytopenia (ITP) |Competitive Intelligence

Sai Kiran

DataM Intelligence 4market Research LLP

+1 877-441-4866

email us here

Visit us on social media:

LinkedIn

X

Distribution channels: Healthcare & Pharmaceuticals Industry

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release